Financial technology is the innovation and technology that seek to compete with more traditional financial practices in the provision of financial services. Financial technology has developed a lot over the years as the internet becomes an integral part of our everyday lives. Financial technology is also an emerging field that makes use of new technology to enhance financial activities in finance.

One of the main attractions for traditional banks when they consider offering fintech services is the fact that they do not have to change their business model. They simply need to upgrade their infrastructure to accommodate these new services and can then focus on providing better customer service and more customer convenience. In addition to this, the traditional financial institutions are feeling the pressure from the increasing number of customers who have started to rely on online resources to obtain their financial needs.

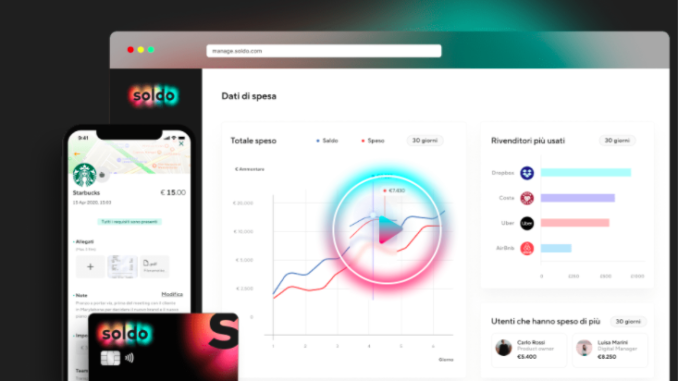

Fintech companies depend on customers and generate a profit by providing financial services based on their clients’ needs. A major part of any fintech organization is its IT systems and software. These systems and software to help the company to process and manage financial data, reports and analytics much faster and efficiently. In effect, it helps reduce costs and increase profitability.

As the field of fintech grows, more financial institutions are seeking venture capitalists to help fund their ventures. Venture capital represents a pool of money that entrepreneurs can invest in early-stage companies to help them develop into profitable businesses. V Venture capital is a common tool for banks and other traditional institutions looking to tap the venture capital market. As a matter of fact, many banks and other lending institutions are looking for venture capital firms to provide the equity financing they need in order to execute strategic projects. Venture capital represents a crucial resource for the financial industry and provides a significant amount of leverage for smaller companies.

Many financial service providers are also looking for ways to cut their costs and increase customer satisfaction. One way this is done is through fintech integration. Banks and other financial services companies use many fintech technology companies to increase efficiency and save time while reducing costs. Integration allows these companies to integrate banking and other financial services with fintechs to provide customers with faster, easier, and more convenient access to financial advice. Integration is especially helpful for smaller banks and credit unions that do not have the capital or the staff to develop their own software platforms.

A number of banking organizations and other lending institutions are turning to fintech innovation to provide themselves with solutions to customer problems. Consumers may be confused about which technology company to use when looking for financial advice. However, with so many options available to them, consumers have more choices than ever before. Today, consumers have more access to information and technology than ever before. Many biotech companies have developed products that will enable consumers to make informed choices about their banking needs.